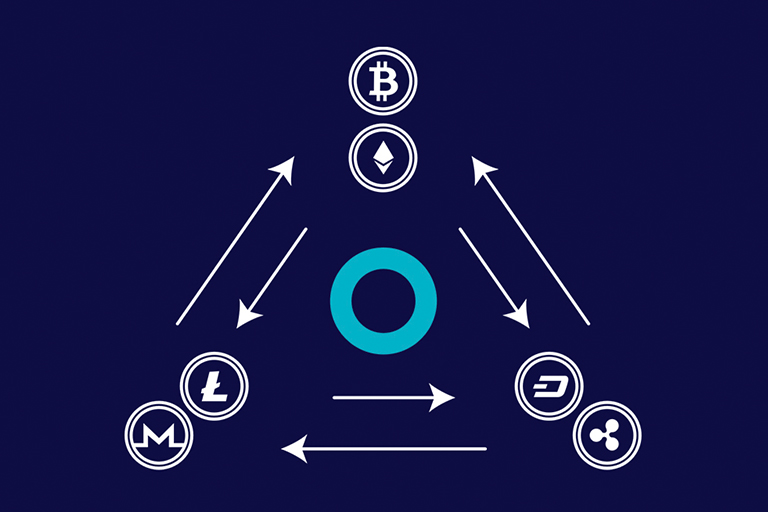

Arbitrage trading is a low risk strategy that allows you to take advantage of price differences across different markets.

A difference in the price of a cryptocurrency between two or more exchanges is an Arbitrage opportunity.

Arbitrage trading is profitable, but not very profitable, since there are not always much differences. And because there’s fierce competition, its even harder. Nevertheless, it’s the it’s the closest to guaranteed profit in crypto 😅

How can I do arbitrage trading?

The best and most common form of Arbitrage trading is done on crypto exchanges. What this involves is yiu buy a crypto asset from one exchange, and sell on another exchange.

The last Bitcoin dip had BTC at $30,000 on most exchanges. However, some had BTC at $28,000 and around $31,000 as the button.

An Arbitrage trader who buys BTC for $28,000 can sell on another exchange for $30,000. This is how profit is made with this strategy.

Since competition is force, as mentioned earlier, algorithms developed by high-frequency trading (HFT) firms are used.

Depending on trading volume of the particular crypto asset, you can do Arbitrage trading with no need for any algorithm.

Although the risks with Arbitrage trading is relatively low, there are still some risks you should keep in mind.

One of them being that if you’re not fast enough, you will end up selling low and having no other option but to buy high.

In some cases, there may not be enough liquidity for you to execute this trade.

But it’s something you may look into, provided you have the speed and capital needed to take advantage of market movements.

Let us know if you’re a fan of Arbitrage trading, and what your recommendations are in the comment section below.