AAVE has just announced the introduction of their new protocol – AAVE V3

Back in 2009, the first version of the protocol was launched. It was referred to at the time as Aave Protocol and was deployed on the Ethereum mainnet.

This allowed users to provide and obtain liquidity in a decentralized way while earning yields on the liquidity provided to the protocol

As DeFi advanced, there was the need to launch a V2 of the Aave protocol in December of 2020. The Aave V2 brought the following features among others:

- Credit delegation

- Gas optimization

- Stable and variable interest rates

The Governance system gained control of the protocol around that time and helped with the tremendous growth Aave has seen in the past year.

With support from the community, Aave’s protocol expanded from Ethereum mainnet to Polygon and Avalanche’s networks. All of these growths are organic.

If the proposal is implemented, it will be a significant upgrade on from DeFi liquidity protocols as we know them at the moment.

Here are the features of Aave V3:

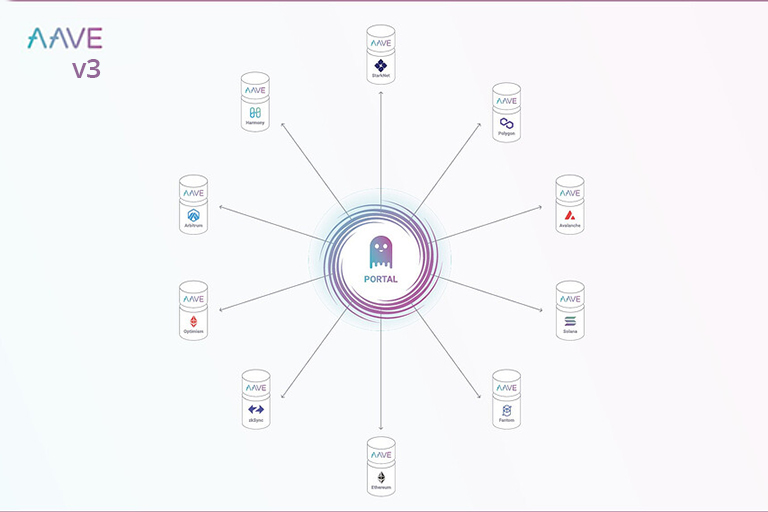

- Portal: Allows assets to seamlessly flow between Aave V3 markets over different networks;

- High Efficiency Mode: Allows borrowers to extract the highest borrowing power out of their collateral;

- Isolation Mode: Limits exposure and risks to the protocol from newly listed assets by only permitting borrowing up to a specific debt ceiling;

- Risk Management Improvements: Provides additional protection for the protocol through various risk caps and other tools;

- L2-Specific Features: Designs specific to Layer 2 networks to improve user experience and reliability;

- Community Contribution: Facilitates and incentivizes community usage through a modular, well-organized codebase.

These features make V3 the most robust and efficient DeFi liquidity protocol ever designed.

Read the full update from AAVE about the V3 update >>> here <<<